CCR

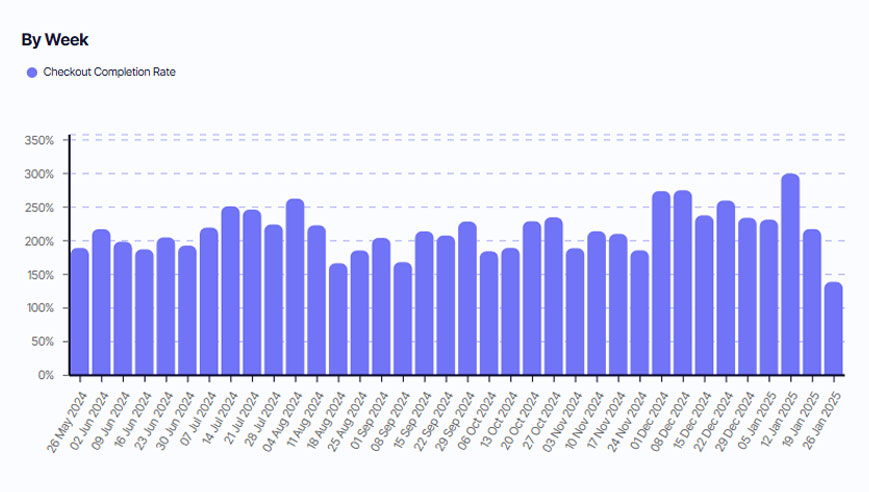

Checkout Completion Rate (CCR) measures the percentage of customers who start the checkout process and successfully complete their purchase. Improving CCR directly impacts revenue by reducing cart abandonment at the critical final step.

Understanding CCR

Checkout Completion Rate is essential for understanding the efficiency of your checkout process. A high CCR indicates a smooth and straightforward checkout experience, while a low rate highlights issues that are putting customers off at the final step.

CCR focuses solely on the checkout process itself, not the entire customer journey from browsing to purchase. This distinguishes it from overall conversion rate metrics, which measure the full funnel from site visit to purchase. CCR isolates the specific moment when customers have already decided to buy and evaluates how effectively your checkout process converts that intent into completed transactions.

How to Calculate CCR

CCR = (Number of Completed Transactions / Number of Initiated Checkouts) × 100

Give it a go in our CCR calculator!

CCR Calculator

Calculation Example

Suppose your checkout process needs to maintain at least an 85% completion rate to meet your revenue targets. You're seeing 2,000 customers initiate checkout this week. Calculate the minimum number of completed transactions you need:

Minimum Completed Transactions = Target CCR × Checkouts Initiated

Minimum Completed Transactions = 0.85 × 2,000

Minimum Completed Transactions = 1,700 transactions

Aim to convert at least 1,700 of your 2,000 checkout initiations into completed purchases to maintain your target 85% CCR and meet revenue expectations.

What’s Considered a Healthy CCR?

A "healthy" Checkout Completion Rate varies by industry, device type, and customer segment, but most successful ecommerce sites target 75-85% or higher:

● Device type creates significant variation. Desktop checkout completion rates typically range from 75-85%, while mobile rates are often 10-20 percentage points lower (60-70%) due to form complexity, input friction, and distraction factors. If your mobile CCR is dramatically lower than desktop, the issue is likely user experience rather than customer intent.

● Industry and product type influence benchmarks. High-consideration purchases (furniture, electronics, luxury items) often show lower CCR (60-75%) as customers comparison shop even after starting checkout. Low-consideration, impulse purchases (fashion, consumables, digital products) typically achieve higher CCR (75-90%) as customers commit more readily once they've decided to buy.

● New vs. returning customers show different patterns. First-time buyers often have 10-15 percentage points lower CCR than returning customers due to unfamiliarity with your process, account creation friction, and trust hesitation. Returning customers with saved payment information frequently exceed 85-90% completion rates.

● Traffic source affects checkout intent quality. Email and branded search traffic typically shows the highest CCR (80-90%) as these customers have strong purchase intent. Social media and display ad traffic often shows lower rates (60-75%) as the customer journey is less mature and intent less concrete.

● Geographic and payment method availability impact rates. Regions where your preferred payment methods are uncommon or shipping is expensive typically show 15-25 percentage points lower CCR. Offering local payment methods and transparent shipping costs dramatically improves regional completion rates.

Tip: The most important benchmark is your own historical baseline segmented by device, customer type, and traffic source. A 5-10 percentage point improvement in CCR can represent hundreds of thousands in recovered revenue—even small optimizations at this stage deliver outsized impact since customers have already demonstrated purchase intent.

CCR FAQ

What's the main difference between CCR and overall conversion rate?

Conversion rate measures the percentage of site visitors who make a purchase (entire funnel), while CCR measures only the percentage who complete checkout after starting it (final step). A site might have 3% conversion rate but 80% CCR—meaning 3% of visitors buy, but 80% of those who start checkout finish it. CCR isolates checkout process effectiveness from earlier funnel stages like product discovery and add-to-cart decisions.

What's the biggest cause of low CCR?

Unexpected costs revealed at checkout—particularly shipping fees—cause 60% of cart abandonment according to industry research. Customers proceed to checkout expecting one total, then abandon when final costs exceed expectations. Display shipping estimates early, offer free shipping thresholds, or build shipping into product pricing to eliminate surprises. Payment security concerns and complicated checkout forms are the second and third leading causes of abandonment.

Should I require account creation before checkout?

No. Forced account creation before checkout typically reduces CCR by 20-30 percentage points. Offer guest checkout and optionally suggest account creation after purchase completion when the customer is satisfied and receptive. Many customers who initially resist account creation will voluntarily create accounts for their second purchase if the first experience was positive. The revenue lost to forced registration far exceeds any benefits from having registered users.

How can I improve mobile CCR specifically?

Mobile CCR improvement requires mobile-specific optimization: implement mobile wallets (Apple Pay, Google Pay) for one-tap checkout, use large tap targets and minimal typing requirements, enable address auto-complete and smart form field detection, reduce checkout to single screen with logical grouping, and test extensively on actual devices. Mobile users have higher friction tolerance thresholds—what seems minor on desktop becomes abandonment-inducing on mobile.

Does offering more payment options improve CCR?

Yes, significantly. Each additional relevant payment method typically improves CCR by 2-5 percentage points. However, "relevant" is key—offering 10 obscure payment methods helps less than offering the 3-4 methods your customers actually prefer. Research your customer base and geography to identify which payment methods matter. Buy-now-pay-later options (Klarna, Afterpay) can improve CCR by 10-20% for higher-ticket items by reducing immediate financial friction.

How do I know which checkout step causes the most abandonment?

Implement funnel tracking that measures completion at each checkout stage: contact information, shipping address, shipping method, payment information, and order review. Calculate step-specific completion rates to identify where customers exit. If 95% complete contact info but only 70% complete payment info, the issue is in payment or the steps between. Use session recordings and heatmaps to understand why customers abandon at specific steps—often the data reveals unexpected friction points.ShareArtifactsDownload allConversion rate optimization guideDocument · MD Conversion rate reformattedDocument · MD